Fitzroy Minerals Reports 200 m at 0.83% CuEq, Including 42 m at 2.31% CuEq in New Copper-Molybdenum-Gold-Rhenium, Mineralizing System Identified at the Caballos Copper Project, Chile

VANCOUVER, BRITISH COLUMBIA, March 27, 2025 – FITZROY MINERALS INC. (TSXV: FTZ, OTCQB: FTZFF) (“Fitzroy Minerals” or the "Company") is pleased to announce the results from its first ever drill hole at the Caballos Copper Project (the “Project” or the “Property”) in Chile, with significant intercepts of copper-molybdenum-gold-rhenium mineralization.

Highlights:

- First hole CAB-DDH001 intersected 200 m1 grading 0.46% Cu, 591 ppm Mo, 0.07 g/t Au, (0.83% CuEq2), from a depth of 66 metres:

- including 98 m1 @ 0.78% Cu, 1071 ppm Mo, 0.12 g/t Au, (1.45% CuEq2), from 151 m.

- Including 42 m1 @ 1.20% Cu, 1764 ppm Mo, 0.23 g/t Au, (2.31% CuEq2) from 188 m.

- Mineralization is associated with a hydrothermal breccia controlled by the regional Pocuro Fault Zone with >10 km of strike with anomalous Cu and Mo results across the Caballos Project area.

- Rhenium (“Re”) analysis of selected pulps (150 m - 246 m) by ICP-MS method returned 85 m @ 0.38 ppm Re, with maximum value of 2.42 ppm Re, which are among the highest in Chile3.

- First drill hole ever on the Property identifies new mineralization style, opening up significant new potential.

- Additional drill holes being planned to accelerate advancement of the Project.

Merlin Marr-Johnson, CEO and President of Fitzroy Minerals, commented: "This remarkable intercept from our very first hole at Caballos identifies the potential of a new and significant copper-molybdenum-gold-rhenium system. The hole at Chincolco, Caballos, intersected a thick package of intensely hydrothermally altered, veined and mineralized breccias and felsic intrusions and is located at the centre of a significant Cu-Mo anomaly that extends for over one kilometre along strike. The Pocuro Fault Zone hosts other occurrences of interest along the 12 km of strike within the Caballos project area, notably the Mule Hill anomaly about 5 km north of Chincolco.

Another stand-out feature of the drill hole is the mix of elements. The molybdenum and rhenium grades in this hole are significantly higher than that reported from several Chilean Cu-Mo-Re deposits3. The molybdenum price is 4-5 times higher than the copper price, and rhenium is a strategic mineral essential for many military applications and predominantly produced in Chile. The gold content is significant as well.

All in all, the prospects at Caballos are wide open. The geology shows a compelling mix of highly valuable metals plus significant scale potential. I would like to thank that the entire team that has worked on the Project to date, with special thanks to Gilberto Schubert who has explored this area with tenacity since first reviewing historical stream sediment data in 2005, to the first drill hole in 2025. We are planning a series of additional holes that should start in April.”

Caballos Copper Project, Chile

Chincolco and Mule Hill Anomalies

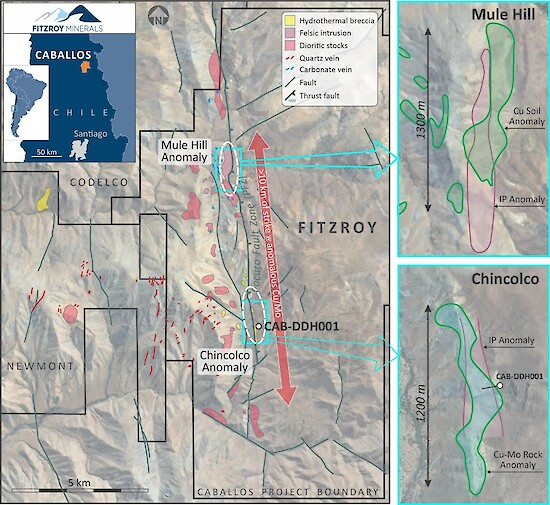

At the Caballos Copper Project, Fitzroy Minerals has advanced work at two distinct anomalies over the regional, deep-seated Pocuro Fault Zone (“PFZ”). Drill Hole CAB-DDH001 targeted the Chincolco Creek anomaly (“Chincolco”). Five kilometres further north is the Mule Hill anomaly (“Mule Hill”), which is similar in size and character to Chincolco (Figure 1).

Mule Hill is defined by a 1,300 m-long soil and rock Cu (Mo-Au) anomaly with results up to 2.0% Cu, 0.4 g/t Au, and 1,670 ppm Mo (0.17% Mo). Mineralisation is associated with felsic intrusions and breccias and localised potassic alteration (K-feldspar and secondary biotite). Historical Induced Polarization (IP) geophysical surveys have shown a good correlation of the geological and geochemical anomalies with a subtle chargeability anomaly (>10 mV/V), which extends at least 300 m to the south, beyond the geochemical anomaly.

By way of comparison, the surface expression at Chincolco is a 1,200 m-long rock-chip Cu (Mo-Au) anomaly with results up to 2.1% Cu, 1.1 g/t Au and 1.2% Mo. The anomaly is strongly fault-controlled and associated with a sericite-limonite-tourmaline breccia. This mineralized zone is approximately 160 m wide and historical IP surveys indicate that it is associated with a subtle chargeability anomaly (>10 mV/V). The average of 30 samples collected in 2024 from the hydrothermal breccia at Chincolco was 0.84% Cu. Sixteen samples define the molybdenum anomaly, with an average grade of 897 ppm Mo.

Drill hole CAB-DDH001 is located in the centre of the Chincolco anomaly, drilling across it towards the west (Figure 1).

Figure 1. Location map of the Caballos Project and the Mule Hill and Chincolco anomalies.

Drill Hole CAB-DDH001

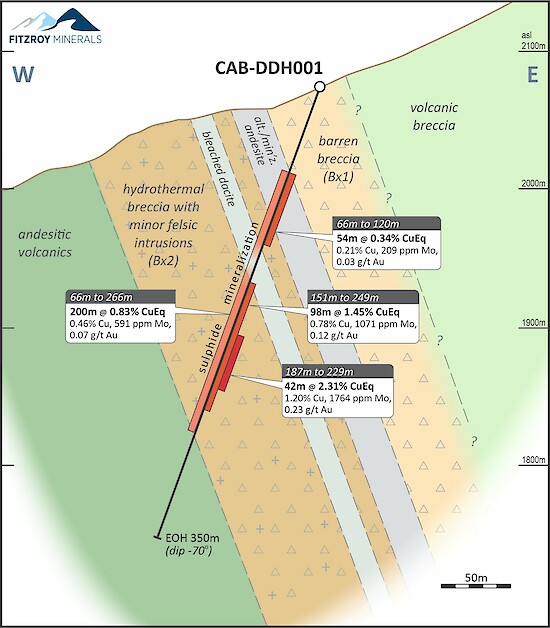

As reported on 10 February 2025, the drill hole at Caballos was oriented with an azimuth of 260 degrees and a dip of 70 degrees. The hole was collared in the Breccia Zone and completed to a length of 350.0 m, ending in unmineralized andesitic volcanic rocks.

The rocks are strongly controlled by the PFZ and show varying degrees of structural deformation and development of tectonic fabrics. From surface to a depth of 65 m, the drill hole intersected a barren breccia (Bx1), which is then followed by altered and mineralised andesites to a depth of 108 metres. From 108 m, a hydrothermally altered and mineralized breccia (Bx2) with felsic intrusions and multiple phases of veining and deformation is the dominant lithology down to a depth of 251 metres. Within this larger unit there are a few xenoliths or megaclasts and a bleached dacitic unit with some pyrite and no value minerals is evident from 127 m to 150 metres. After a faulted contact at 251 m, the dominant lithologies are altered andesitic volcanics with minor hydrothermal breccia intercalations and veining, decreasing away from the PFZ.

Figure 2. Drill hole CAB-DDH001 cross-section, Chincolco anomaly, Caballos Copper Project, Chile.

Assay Results and Mineralization

Assay results returned an interval of 200 m @ 0.46% Cu, 591 ppm Mo, and 0.07 g/t Au, from a down-hole depth of 66 metres.

Mineralization is characterized by a lower grade section at the top of the hole and a higher grade section below the barren dacitic unit. The upper mineralization zone returned 54.0 m @ 0.21% Cu, 209 ppm Mo, and 0.03 g/t Au (0.34% CuEq) from 66 metres. The lower intercept returned 98.0 m @ 0.78 % Cu, 1,071 ppm Mo, and 0.12 g/t Au (1.45% CuEq) from 151 metres. Within this interval, there is a zone of more intense mineralization that returned 42.0 m @ 1.20% Cu, 1,764 ppm Mo, 0.23 g/t Au (2.31% CuEq) from 187 metres. Sporadic values of silver (up to 613 g/t Ag) and zinc (up to 1.4% Zn) are also observed in the hole.

| Table 1. Drill hole CAB-DDH001 selected results, Chincolco anomaly, Caballos Copper Project, Chile | ||||||

| Lat / Lon: -32.2751375; -70.5690144 | ||||||

| From (m) | To (m) | Interval (m) | Cu (%) | Mo (ppm) | Au (g/t) | CuEq (%)1 |

| 66.0 | 266.0 | 200.0 | 0.46 | 591 | 0.07 | 0.83 |

| Including: | ||||||

| 151.0 | 249.0 | 98.0 | 0.78 | 1071 | 0.12 | 1.45 |

| Including: | ||||||

| 187.0 | 229.0 | 42.0 | 1.20 | 1,764 | 0.23 | 2.31 |

1 Copper Equivalent (“CuEq”) calculated using metals reported in situ (100% basis). CuEq is calculated using the formula CuEq % = Cu % + (7467.1029 * Au g/t /10,000) + (5.3559 * Mo g/t /10,000) and three year trailing average prices for 2022, 2023 and 2024: Cu $3.99/lb, Au $2,043/oz, Mo $21.37/lb

As previously reported, there are varying amounts of chalcopyrite, molybdenite and pyrite throughout the majority of the PFZ breccia. The breccia is highly altered, with clasts often rich in a mixture of silica, tourmaline, albite, K-feldspar, cut by carbonates and gypsum veinlets. The chalcopyrite content typically increases with the presence of tourmaline clusters. Molybdenite occurs as disseminations associated with chalcopyrite and occasionally as discrete veinlets.

Field measurements and the down-hole intersection of footwall contact show that the breccias have a dip of approximately 70 degrees to the east. True widths of the intercepts are approximately 75% of down-hole intervals. The lower (western) contact of the hydrothermal breccia with andesitic volcanic rocks is characterized by chlorite-epidote alteration.

Discussion and Next Steps

Drill hole CAB-DDH001 is the first hole ever drilled at Caballos, located in the centre of the approximately 1.2 km-long Chincolco anomaly. It is important to note that the tenor of the mineralization identified down-hole was similar to the grade of the surface sampling and that the hydrothermal breccia unit associated with the Cu-Mo anomaly covers a surface area of approximately 140,000 m2.

Next steps will include testing strike- and dip-extent of the Chincolco mineralization through step-out drilling. The strength of the mineralizing system and associated grades intersected in the first hole, increase the prospectivity of the entire Pocuro Fault Zone, including Mule Hill which is about 5 km to the north. The PFZ is a regional geological feature that is a broadly planar structure with vergence towards the west (dipping to the east).

Molybdenite samples have been submitted for Os-Re dating which, if successful, will help place the mineralization within a regional context. Drilling is anticipated to restart at Chincolco, Caballos Project, in April 2025.

Molybdenum and Rhenium

Molybdenum (“moly”) is a 260,000 tonnes per year (tpa) market, with China producing 110,000 tpa. Chile is the second largest moly producer in the world, reaching 53,000 t in 2023 (USGS data)4. Chilean copper porphyries often show a negative correlation between moly and gold, but here there is a positive correlation. Moly is a valuable by-product in copper porphyries in Chile even though grades can be relatively low (e.g., Los Pelambres 150 ppm Mo, El Teniente 190 ppm Mo, Los Bronces 200 ppm Mo, Collahuasi 400 ppm, Chuquicamata 400 ppm)3. The moly grades from drill hole CAB-DDH001 are noteworthy. The moly price is currently US$20.9/lb and the three year trailing average price is US$19.7/lb.

Rhenium (Re) is a 45,000 kg annual market and is one of the scarcest elements in the Earth’s crust. It is a dense metal with very high melting and boiling points. The metal never fractures and helps prevent brittle fracture in super-alloys. It is used in the aerospace and high tech and military sectors. USGS data indicates that 40,000 kg of the global production of Rhenium is associated with molybdenite in Chilean porphyries. The rhenium grades from drill hole CAB-DDH001 are noteworthy. Rhenium is worth about US$90/oz. The Re content at Caballos has the potential to add value to the mineralized material and to be a strategically important source of the material as in other areas of Chile.

Core Preparation, Sampling and Assaying

The Caballos Project diamond drill core is collected from site by FTZ staff and transported to the Company's nearby sampling facilities where it is then processed for geological, geotechnical, and geochemical data. Sampling intervals were all of 1 metre. The core is cut into two halves using an electric diamond brick (core) saw with half-core samples each allocated a unique identifier code and bagged-tagged separately. Samples for each complete hole are transported by Fitzroy Minerals personnel to AAA laboratories in Santiago, Chile for sample preparation (drying, weighing, crushing and grinding) and assayed for Au (by 40 g fire assay with AAS finish method) plus a suite of 31 elements including Cu and Mo (by aqua regia digestion and ICP-AES finish). One batch of pulps from AAA was sent to ALS laboratories in Lima, Peru for check assays and rhenium assay by ICP-MS.

Sampling and assaying Quality Assurance-Quality Control (“QAQC”) protocols employed by the Company for this drill hole include routine insertion of certified reference materials (“CRM”) including standards and blanks. Results for each CRM is assessed to monitor the accuracy and precision of the assay data for the core samples.

Qualified Person

Dr. Scott Jobin-Bevans (P.Geo., Ph.D.), a Qualified Person as defined by National Instrument 43-101 and independent geological consultant to the Company, has reviewed and verified the technical information provided in this news release, including the sampling, analytical and test data underlying the technical information contained in this news release. Specifically, the QP verified laboratory assay certificates against the reported drill core intervals as well as drill core logs against the geology, as supplied by the Company.

About Fitzroy Minerals

Fitzroy Minerals is focused on exploring and developing mineral assets with substantial upside potential in the Americas. The Company’s current property portfolio includes the Caballos Copper and Polimet Gold-Copper-Silver projects located in Valparaiso, Chile, and the Taquetren Gold project located in Rio Negro, Argentina, as well as the Cariboo project in British Columbia, Canada. Fitzroy Minerals’ shares are listed on the TSX Venture Exchange under the symbol FTZ and on the OTCQB under the symbol FTZFF.

On behalf of Fitzroy Minerals Inc.

Merlin Marr-Johnson

President and CEO

For further information, please contact:

Merlin Marr-Johnson

mmj@fitzroyminerals.com

+44 7803712280

For more information on Fitzroy Minerals, please visit the Company's website: www.fitzroyminerals.com

Neither Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to the potential mineralization on the Company’s mineral properties, future exploration plans on the Company’s mineral properties and the timing and results of future exploration.

Statements contained in this release that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of the Company. Such statements can generally, but not always, be identified by words such as "expects", "plans", "anticipates", "intends", "estimates", "forecasts", "schedules", "prepares", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. All statements that describe the Company's plans relating to operations and potential strategic opportunities are forward-looking statements under applicable securities laws. These statements address future events and conditions and are reliant on assumptions made by the Company's management, and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators, including without limitation, the dangers inherent in exploration, development and mining activities; actual exploration or development plans and costs differing materially from the Company’s estimates; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; fluctuations in exchange rates; the availability of financing; operations in foreign and developing countries and the compliance with foreign laws, remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; and competition with other mining companies. As a result of these risks and uncertainties, and the assumptions underlying the forward-looking information, actual results could materially differ from those currently projected, and there is no representation by the Company that the actual results realized in the future will be the same in whole or in part as those presented herein. the Company disclaims any intent or obligation to update forward-looking statements or information except as required by law. Readers are referred to the additional information regarding the Company's business contained in the Company's reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on the Company and the risks and challenges of its business, investors should review the Company's filings that are available at www.sedarplus.ca.

The Company provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company does not undertake to update any forward-looking statements, other than as required by law.

1 True thickness estimated to be 75% of drill hole intercept.

2 Copper Equivalent (“CuEq”) calculated using metals reported in situ (100% basis). CuEq is calculated using the formula CuEq % = Cu % + (7467.1029 * Au g/t /10,000) + (5.3559 * Mo g/t /10,000) and three year trailing average prices for 2022, 2023 and 2024: Cu $3.99/lb, Au $2,043/oz, Mo $21.37/lb

3 By-Products of Porphyry Copper and Molybdenum Deposits, David A. John, and Ryan D. Taylor, SEG 2016, Reviews in Economic Geology, v. 18, pp. 137–164.

4 https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-molybdenum.pdf