Buen Retiro

Buen Retiro Project

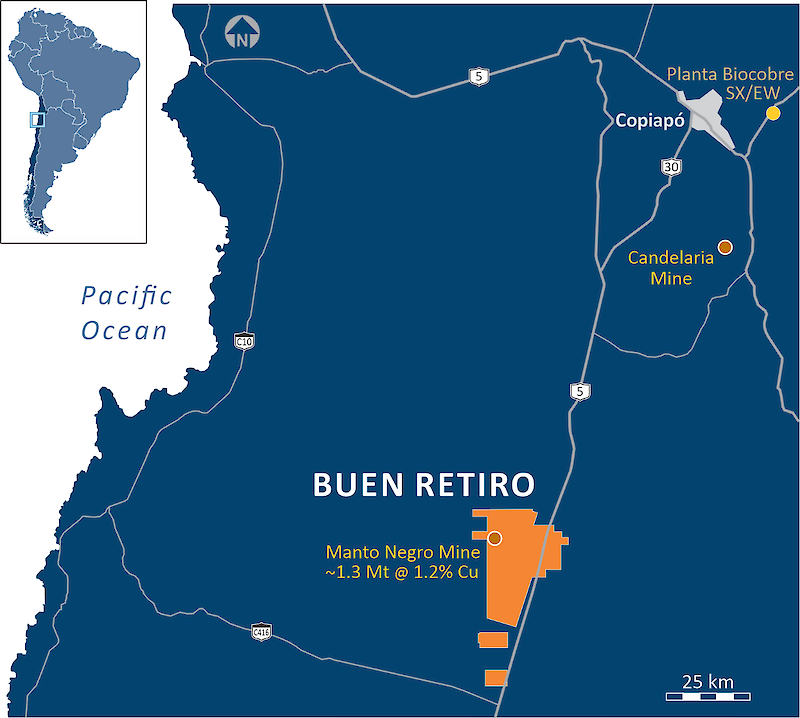

The Properties are situated close to the Candelaria deposit in the Punta del Cobre iron-oxide-copper-gold (“IOCG”) district of Copiapó, Chile. High grade copper oxide ore was mined from 2005 to 2009 at Manto Negro and trucked 60 km to a processing plant in Copiapó. The Manto Negro open pit is 43 km southwest of Candelaria, 35 km from the coast, and 5 km from the Pan American Highway and high voltage transmission lines. The Buen Retiro Project has a wealth of information, including assay data from

28,290 m of historic drilling records; core and data from 4,895 m of recent diamond drilling; and raw and interpreted data from extensive geophysical surveys.

In 2023 land tenure across the Properties was consolidated and the first ever systematic review and subsequent exploration of the wider Buen Retiro Project area was conducted. The concessions, totalling 13,840 ha, are held through two distinct option agreements with local parties. Exploration is on-going and the Buen Retiro Project is at a pre-resource, advanced exploration stage of development. Fitzroy Minerals believes that the Buen Retiro Project-Chile has the potential to host a promising IOCG copper deposit.

Location and Setting

The Buen Retiro Project is located approximately 60 km south of Copiapó in northern central Chile (see Figure 1). The area is known for its copper mineralisation and mining culture. A series of iron oxide Cu-Au (+/- Co) deposits of varying sizes are located within a ~20 km x 5 km, north-south elongated, Punta del Cobre belt to the south of Copiapó. The district includes the Alcaparrosa, Carola, Española, Punta del Cobre, Santos, Socavón Rampa and Trinidad deposits and the much larger Candelaria deposit. The Candelaria operation is owned by Lundin Mining with 2024 production guidance of 160,000-170,000 tonnes of copper and 100,000-110,000 ounces of gold1. As at December 31, 2022 (Lundin Mining 2022 Mineral Resource and Reserve Estimates) the Candelaria mineral resources were (after 25 years of mining) still over a billion tonnes of total measured and indicated mineral resources2 (see Table 1).

The historical Manto Negro open pit within the 13,840 ha Buen Retiro Project area is 43 km southwest of Candelaria, and 35 km east of the coast. The old pit is located 5 km west of the Pan-American Highway and high voltage transmission lines which themselves cross the eastern portion of the Buen Retiro concessions. The terrain is low relief desert, characterised by low hills and gravel cover, at an average altitude of 370 m.

Figure 1. Location of the Buen Retiro Copper Project, Copiapo, Chile

Work Summary

The Manto Negro copper oxide mine was operated from 2005-2009 by Pucobre Ltd (“Pucobre”). Pucobre is a listed Chilean mining company that produced 77.5 million pounds of copper in 20233. Pucobre owns an SX/EW plant located 13 km from Copiapo, Planta Biocobre. Records indicate that approximately 1.3 Mt @ 1.2 % CuS (estimated recoverable grade, which has not been confirmed by a QP) was transported from Manto Negro to Planta Biocobre when the mine was active.

The Manto Negro Mine is an historical resource and a conceptual study was prepared in January 2005 by NCL Ingeniería y Construcción S.A. The NCL (2005) report was presented by Pucobre to the Chilean government’s Environmental Assessment Service (SEA) as part of their environmental impact assessment system registration (“SEA”) and their simplified environmental impact statement (DIA) application for the development of the Manto Negro open pit mine. Pucobre internal reports made available to Fitzroy Minerals Inc show total production of 1.3 Mt @ 1.2% Cu (soluble). Further historical information on Buen Retiro, as required under section 3.3 of NI 43-101 is disclosed in the Technical Report titled “National Instrument 43-101 Technical Report for the Buen Retiro Copper Project” with an effective date of August 15, 2024 and an issuing date of October 23, 2024.

The project database comprises almost 33,000 m of historical drill assay data, of which 4,895m was completed in 2023-2024. The database also consists of recent aerophotogrammetry-generated high-resolution orthomosaics and topography, 380 line-km of ground magnetics, 90 line-km of induced polarisation (pole-dipole with 100 m and 50 m spacing), and ground gravimetrics from 178 stations. The recent surveys were designed to fill gaps in historical data and provide better resolution where possible. In addition, a recent historical percussion drilling exercise (down the hole or “DTH” drilling) to test the geology below gravel cover in an area to the north of the old open pit mine and near diamond drill hole BRT-DDH03 was completed. The average gravel thickness was 10.9 m from 43 holes drilled, and the DTH holes recovered approximately 3.0 m of chips from oxidised bedrock that were analysed using XRF analyser techniques.

Results

Results as reported on 30 October 2024, in the news release titled “Fitzroy Minerals Announces Acquisition of Ptolemy Mining Limited” are as follows:

North of the old pit at Buen Retiro, Ptolemy has intersected disseminated sulphide mineralisation that is similar to Candelaria-style mineralisation, including 21 m @ 0.41% Cu and 0.11 g/t Au, from 241 metres. Around and to the south of the old pit, Ptolemy has intersected classic Punta del Cobre-style IOCG mineralisation consisting of chalcopyrite and minor bornite and chalcocite associated with hematite-rich breccias, sub-vertical structural zones, and intrusive rocks. The median intersection across all 14 Buen Retiro Property drill holes to date is 27 m @ 0.55% Cu. Stand-out intersections include 30 m @ 3.50% Cu, from 130 m in hole BRT-DDH13 and 135 m @ 0.73% Cu from surface in hole BRT-DDH06. Information on Phase 1 Drilling, as required under section 3.3 of NI 43-101, is disclosed in the Technical Report titled “National Instrument 43-101 Technical Report for the Buen Retiro Copper Project” with an effective date of August 15, 2024 and an issuing date of October 23, 2024. True widths of mineralization are not known and the interval shown reflects the length of core drilled..

Oxides and Sulphides

The depth to fresh rock at Buen Retiro Project is greater than 100 m in zones of intense structural activity, especially to the south of the old open pit. To the north, where mineralisation exhibits a stronger stratigraphic control and the intensity of faulting is less evident, the oxides extend down to a depth of approximately 60-80 m. Native copper is frequently observed at the base of oxidation, reflecting supergene enrichment processes.

Oxide mineralogy is widely known to be favourable to leaching. The minerals identified to date are dominantly tenorite, chalcocite and native copper, with lesser chrysocolla and trace amounts of malachite and azurite. Tenorite (CuO), and Chalcocite (CuS), are both minerals containing 80% Cu. Native copper is 100% Cu, and Chrysocolla [(Cu,Al)2H2Si2O5(OH)4·n(H2O)], is 38% Cu. All of these minerals are typically leachable, some of them in the presence of oxidising agents, such as salt.

The Buen Retiro Option

Ptolemy signed the Buen Retiro Option on July 1, 2023 with certain vendors. The terms of the Buen Retiro Option require a US$7,000,000 work program to be carried out within four years (US$2,000,000 in Year 1, and US$5,000,000 over Years 2 through 4, with no consecutive 12-month period seeing less than US$1,000,000 of expenditures). Investment to date in the Buen Retiro Option is US$1,400,000. In year five, the Buen Retiro Option can be exercised with a US$4,000,000 payment. The project vendors retain a 2% Net Smelter Royalty (“NSR”) of which 1% can be clawed back for US$5,000,000 prior to the start of production. Pucobre is a 50% owner of the Buen Retiro Option, and the remaining 50% ownership is held by arm’s length vendors.

Pucobre retains a 30% clawback right (“Clawback Right”) within the Buen Retiro Option concessions. Under the terms of the Clawback Right, after completion of the acquisition by Ptolemy, Pucobre has the right to purchase up to 30% of the local subsidiary that holds the asset. The purchase price of this transaction will be three times 30% of the addition of the following amounts: (i) a fixed amount of USD$300,000 and (ii) all the investment made by Ptolemy in relation to the Buen Retiro Option. Following completion of any clawback, Pucobre will fund the project on a pro rata basis or be diluted.

The Sierra Fritis Option

Ptolemy signed the Sierra Fritis Option on October 1, 2023 with an arm’s length vendor. The terms of the Sierra Fritis Option require a US$2,600,000 work program to be carried out within four years (US$500,000 in Year 1, and US$2,100,000 over Years 2 through 4, with no consecutive 12-month period seeing less than US$350,000 of expenditures). Investment to date in this Sierra Fritis Option is US$450,000. In year five, the Sierra Fritis Option can be exercised with a US$50,000 payment. The project vendors retain a 2% NSR of which 1% can be clawed back for US$5,000,000 prior to the start of production.

QA/QC

In the Buen Retiro Project, almost all core is cut by diamond saw and sent for laboratory analysis. Only the initial sections of gravel and calcrete remain un-cut and are not analysed. 99.5% all the samples are 1 m in length. Once cut, the samples are bagged and immediately sent for preparation and analysis in the ALS-Patagonia laboratory. All the samples are analyzed by ME-ICP 41 for 36 elements and, when the results exceed 1000 ppm of Cu, CuT% and CuS% assays are automatically carried out by Atomic Absorption and Au Fire Assay, respectively.

The remaining half-core is stored in wooden boxes in the warehouse rented by the company in Copiapó. Blanks (white quartz) are inserted every 20 m (or immediately after a section with native copper), totalling 5% of total samples. Rejects and pulps are withdrawn from the laboratory every 3 months and stored by lots in hermetically sealed containers. An equivalent of 5% of total pulps are randomly selected (pulp duplicates), re-identified and sent to the same laboratory, for the same analysis. In addition to these pulp duplicates, pulp standards of high, medium and low grade, for both oxides and sulfide, are inserted in a ratio of 3:1 in the same lots, corresponding to the types of duplicate samples selected. The standards are acquired from IDIEM, a Chilean institution with international certification.

1 https://lundinmining.com/operations/candelaria-mine/

2 Technical Report for the Candelaria Copper Mining Complex, Atacama Region, Region III, Chile, February 22, 2023

3 Pucobre website (https://www.pucobre.cl/) Financial accounts for the years ending 31 December 2023 and 2022, and independent auditor’s report, p.88.

Subscribe for Updates

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.